How to Check Income Tax Refund Status: A Step-by-Step Guide

Filing your income tax return is a significant task, but tracking your refund status can be just as important. Knowing the status of your refund ensures that your tax return has been processed correctly and helps you manage your financial planning. This guide will walk you through the process of checking your income tax refund status with practical steps and examples.

Why Check Your Refund Status?

Understanding the status of your income tax refund is crucial for several reasons:

- Verify Processing: Ensures your return has been processed and no errors have occurred.

- Track Timing: Helps you estimate when you might receive your refund.

- Resolve Issues: Identifies any problems or delays in processing that may need your attention.

Methods to Check Income Tax Refund Status

The methods to check your income tax refund status typically include online portals, telephone services, and email. Here’s a detailed look at each method:

1. Online Portals

Most tax authorities provide an online portal where taxpayers can check the status of their refunds. Here’s how you can use these portals:

1.1. For the United States (IRS)

- Visit the IRS Website: Go to the IRS’s official website at www.irs.gov.

- Use the “Where’s My Refund?” Tool: This tool provides real-time status updates on your refund. You’ll need to enter:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Your filing status (e.g., Single, Married Filing Jointly)

- The exact amount of your refund

- Track Your Refund: Once you’ve entered the required information, click “Submit” to view your refund status. The tool will provide details on whether your refund has been approved, processed, or sent.

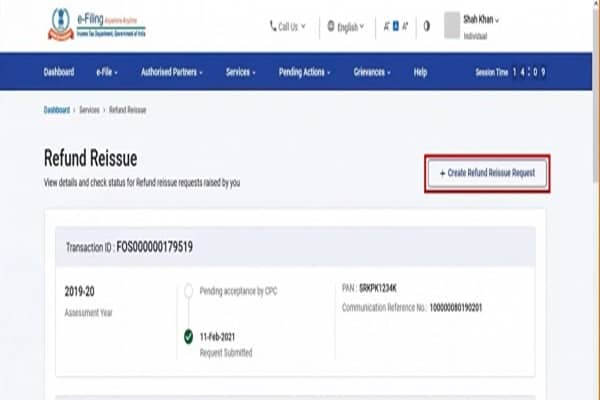

1.2. For India (Income Tax Department)

- Visit the Income Tax India e-filing Portal: Go to https://www.incometax.gov.in.

- Login to Your Account: Use your credentials to log in. If you haven’t registered, you’ll need to create an account.

- Navigate to “Refund Status”: Find the “Refund Status” section under the “My Account” tab.

- Enter Details: You may need to provide your PAN (Permanent Account Number), assessment year, and captcha code.

- View Status: Click “Submit” to view the status of your refund. The portal will display information on whether the refund has been processed or is pending.

2. Telephone Services

Tax authorities often provide telephone services for checking refund statuses. Here’s how you can use these services:

2.1. For the United States (IRS)

- Call the IRS Refund Hotline: Dial 1-800-829-1954.

- Provide Your Information: Be prepared to provide your SSN or ITIN, filing status, and the exact amount of your refund.

- Follow the Instructions: The automated system will provide information on your refund status or direct you to a representative if needed.

2.2. For India (Income Tax Department)

- Call the Income Tax Helpline: Dial 1800-180-1961.

- Provide Your PAN: You may need to provide your PAN and other details as requested.

- Follow the Instructions: The helpline will provide information on your refund status or guide you on next steps.

3. Email Services

In some cases, you may be able to check your refund status via email. This method varies by country and tax authority.

3.1. For the United States (IRS)

- Email Communication: While the IRS does not typically offer email support for refund status, you can contact them via their online contact forms or social media channels for guidance.

3.2. For India (Income Tax Department)

- Email Support: You can email the Income Tax Department at helpdesk@incometax.gov.in for assistance.

- Provide Details: Include your PAN, assessment year, and details of your refund request.

Common Issues and Solutions

When checking your refund status, you may encounter some common issues. Here’s how to address them:

1. Refund Status Not Available

- Check Processing Time: Refund processing can take several weeks. If you’ve recently filed, it might take some time for your status to update.

- Verify Information: Ensure that the information you’ve entered (e.g., SSN, PAN, refund amount) is accurate.

- Contact Support: If the status remains unavailable after a reasonable period, contact the tax authority’s support service for assistance.

2. Refund Delays

- Processing Delays: Refunds may be delayed due to high volume or additional review processes. Check the tax authority’s website for updates on processing times.

- Additional Documentation: Sometimes, additional documentation or information may be required, which can delay processing.

3. Incorrect Refund Amount

- Review Your Return: Double-check your filed return for any errors or discrepancies in the refund amount.

- Contact Tax Authority: If there’s a significant difference between the expected and actual refund, contact the tax authority for clarification and resolution.

Tips for Efficient Refund Tracking

- Keep Records: Maintain copies of your tax returns, refund requests, and any correspondence with tax authorities.

- Monitor Your Account: Regularly check your online tax account for updates and status changes.

- Be Patient: Refund processing can take time, especially during peak tax seasons. Allow a reasonable period before following up on delays.

Conclusion

Checking your income tax refund status is a straightforward process, but it requires attention to detail and understanding of the available methods. By using online portals, telephone services, or email, you can efficiently track your refund and address any issues that arise.

Staying informed about your refund status helps ensure that you receive your money in a timely manner and can help you manage your financial planning effectively. If you encounter any problems or need further assistance, don’t hesitate to contact your tax authority’s support services for help.